- Blog

- /

- Raising the Bar: A Guide to Securing Loans for Your Pub

Raising the Bar: A Guide to Securing Loans for Your Pub

Estimated Read Time: 5 Minutes

Pooja Jaiswal , 1 August, 2024

So, you have in mind this perfect, kind of hideaway pub where one would like to drink a pint and enjoy some good conversation. Bringing it to life is going to take quite a lot of financing. Open a new pub or even expand the existing one—everything is possible with a little help from a loan.

Pub loans can be used for a variety of purposes, such as:

- Buying Inventory

- Hiring Staff

- Renovating Your Premises

- Outdoor maintenance, including garden landscaping and outdoor seating areas.

- Buying a Vehicle for the Business

- Paying for Kitchen Equipment

- Marketing and Advertising Costs

Here is an all-in-one guide that will help you with the process and raise your business to the next level. But before that, let’s understand the importance and benefits associated with loans for SMEs in the pub industry.

Importance of Commercial Finance for SMEs in the Pub Industry

For SMEs, access to commercial finance is the most necessary element required in the competitive UK pub industry. Here’s why securing the right financial support is crucial:

1. Initial Capital Investment

Setting up a pub is a capital-intensive activity that covers the initial setup costs for the premises, renovation, inventory, kitchen equipment, marketing, advertisement expenses, and obtaining licenses. Commercial finance provides capital to meet such upfront expenses and lays down the foundation for a business to succeed

2. Cash Flow Management

Every pub suffers cash flow problems, particularly during the off-season times. Commercial finance solutions facilitate managing the cash flow required to cover operational expenses.

3. Expansion Opportunities

The more your pub grows, the more you will want to cater to more customers by increasing your offers, maybe even renovating or opening other premises. Having access to commercial finance enables one to take up such opportunities that come their way without using up their cash reserves. In the process, this enhances sustainable and profitable growth.

4. Staying Competitive

One must reinvest in marketing, new technology, live music events, and enhance the customer experience to be competitive in the pub business. Commercial finance will help you set aside cash for these improvements so that you can maintain an edge in winning and retaining customers.

5. Mitigating Risks

Sudden equipment breakdowns, changes to regulations, or emergency repairs can all lead to unexpected potential expenses that can stretch finances to the breaking point. Having access to commercial finance can provide a fallback position that can help cover unexpected costs without putting the business at risk.

Process to Apply for Loan Application for Pubs Explained

1. Know Your Business

Understanding your business idea is the first step when approaching a lender. This involves:

- Business Plan:

- Do thorough research, analyse, and report on your target market and competition.

- Outline your business idea and strategies for attracting and retaining customers.

- Create a financial plan, including projected income statements, cash flow statements, and balance sheets.

- Budget: Outline your start-up costs against your operating expenses and forecasts of revenue.

- Initial Costs: Includes lease/rent, renovation, equipment, inventory, music system, and necessary licenses such as a liquor license.

- Ongoing Expenses: Utilities, wages/salaries, insurance, marketing, license renewal fees.

- Revenue Projections: Analyse the market research results to project how much revenue you will generate.

- Credit History: Check your personal and business credit scores. Lenders will use this information to assess your reliability.

2. Choose the Right Type of Loan

Understand your requirements and all aspects of different types of loans. Compare APRs to know the real cost, check if the loan terms fit your cash flow, and read customer reviews to know how responsive the lender will be toward issues.

3. Gather Necessary Documentation

Lenders will require a variety of documents to process your application. Commonly requested documents include:

- Business Plan: A blueprint of your pub’s concept and financial projections.

- Tax Returns: Both personal and business returns.

- Legal Documents: Include business licenses (liquor licenses or music licenses), lease agreements, and any other relevant legal paperwork etc.

In addition to these, lenders may also ask for documents such as:

4. Complete the Application

Carefully fill out the loan application, making sure that all the details provided are correct and complete. Any form of negligence or mistake should not appear on the form, which may cause a delay in the process.

5. Prepare for the Interview

Many of them will want to discuss your business plan and financial projections through an interview. Be prepared to answer questions about how you will use the loan, your strategy for making repayments, and where your pub business will gain its revenue from.

5 Simple Steps to Secure Loan for Pubs with Nucleus

Before making a plunge into the loan application process, you will certainly need to know the different kinds of lenders and how their offerings align with your business. Assess your requirements with due care to determine which type of loan aligns best with your goals.

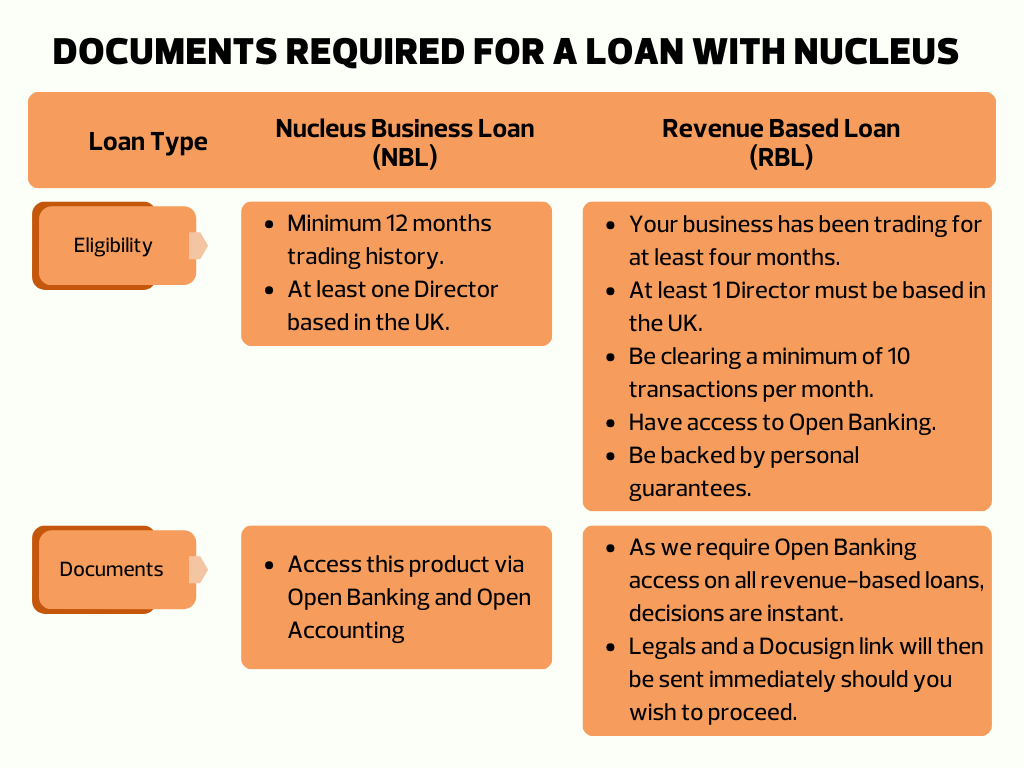

As of today, Nucleus Commercial Finance has backed many SMEs on the road to success with hassle-free funding options, such as Nucleus Business Loans (NBL) and Revenue Based Loans (RBL).

Let’s understand the process:

Step 1: Submit the Application

Understand the type of loan that fits best for your business, then start submitting the loan application by providing details such as business information, trading information, loan information and personal details.

Documents required:

Step 2: Get the Offer

Right after submitting the application, Nucleus’s AI-driven system rapidly assesses your application and makes loan offers according to your financial profile and needs.

Step 3: Accept Your Offer

You can select whether you wish to proceed with the agreement or not. If yes, then you can easily sign your documents on any device at any time remotely and effortlessly, ensuring a seamless and effortless process.

Step 4: Receive Your Funds

Nucleus deposits funds directly into your business account, ensuring hassle-free and swift access to funds for achieving your business goals.

Step 5: Flexible Repayments

Nucleus provides easy repayment options so that one does not feel harassed in managing the availed loan from them. They propose fixed, weekly direct debits, which again support simplified budgeting and ensure that repayments are made regularly.

Summing Up

Commercial finance can be referred to as one of the very important keys to the success and growth of SMEs within the UK’s pub industry, whether in providing initial setup capital, helping with cash flow management, or enabling expansion and competitiveness.

Follow these steps, and with a little help from our flexible financing options at Nucleus, you will be well on the road to securing the financing you need. Apply for a loan, and let’s bring your pub dream to life. Cheers to your success.