- Blog

- /

- Navigating Financial Decisions: The Role of a Business Loan Calculator

Navigating Financial Decisions: The Role of a Business Loan Calculator

Estimated Read Time: 5 Minutes

Diksha Chaphe , 16 August, 2024

When steering your business, it is vital to evaluate a well-educated decision, which is essential to guide your company toward financial success. But how is that possible? The most innovative tool at your disposal is a business loan calculator. Being aware of loan options can remain a game changer when you want to expand your operations, invest in equipment or manage cash flow. Understanding the impact can illuminate the path to financial clarity. Highlighting the calculator’s role in evaluating loan terms, forecasting payments, and optimising your monetary strategy. Join us as we explore how harnessing this tool can result in more strategic choices and a more robust, resilient company.

Statistics And Trends

1. Market Growth: Statista’s 2023 report shows that 60% of UK small businesses use online cost calculators to explore financing options.

2. Adoption Rates: A 2024 survey by the British Business Bank found that 75% of UK SMEs have incorporated interactive financial tools, including credit calculators, into their financial planning process.

3. Impact On Decision Making: Research published in the British Journal of Management in 2023 found that businesses using credit scores reduced the time occupied on loan evaluation by 28% and gained 22% a precise alignment between loan terms and financial strategies.

4. Growth In Fintech: The UK fintech sector, including business loan calculator, has grown by 18% annually over the past five years, as reported by the UK Finance Association in 2023.

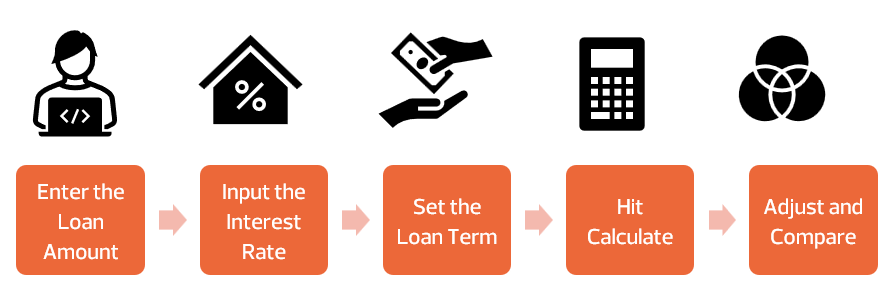

How To Use a Business Loan Calculator

- Step 1: Enter the amount you need to acquire.

- Step 2: Enter the annual percentage rate (APR) the lender charges.

- Step 3: Determine when you will repay the loan. This could be months or years, depending on your contract.

- Step 4: Watch as the tool performs its thing, and voila your monthly payments and total cost appear!

- Step 5: Experiment with different amount interest rates and amounts to see how adjustments impact your payments. This can assist you to negotiate a better deal as per your requirements.

Benefits of Business Loan Calculator

While the calculator remains a fantastic tool, it’s not a one-size-fits-all solution. Utilise it when:

- Exploring Loan Options: Before committing to a lender, use the calculator to determine what each loan offers and whether it really places your financial requirements.

- Planning Budgets: The calculator helps you incorporate loan repayments strategically when setting up your annual budget or financial plan.

- Assessing Financial Health: If you’re considering a new loan, analyse the impact of your existing financial commitments.

What’s The Big Deal About a Business Loan Calculator?

Imagine you’re setting off on a cross-country road trip. Would you begin your journey without a map or GPS? Well, the business loan calculator is like that map for your financial journey. It encourages you to navigate the terrain, plot your course, and avoid those dreaded financial pitfalls.

1. Get The Lowdown on Your Loan.

To start with, the calculator provides an overview of what to expect. By inputting the loan amount and term length, it calculates your monthly payment and total interest required to be paid over the period of time. Essentially, it performs calculations based on loan amount plus interest rates and determines the money you are going to pay and for how long.

2. Compare Your Options.

Did you get multiple loan offers? That’s great, you can determine which loan delivers the most outstanding value by comparing various loans side by side with the help of a business loan calculator. It functions similarly to a financial cheat sheet.

3. Plan For the Future

Are you thinking ahead? There is more to the calculator than just crunching numbers for today; it also bolsters your plans. Are you curious about how additional payments could reduce interest or time? Enter those numbers, then observe as it unfolds. It’s similar to having a trustworthy financial fortune teller.

4. Stay On Budget

No one enjoys surprises—primarily not when it comes to finances. By using the calculator, you can ensure that your monthly loan payments fit snugly into your budget and avoid those dreaded “uh-ohs”. It is a terrific method to prevent your financial journey when you discover that your loan payments are more than anticipated.

5. Make Informed Decisions.

Knowledge is power, right? The calculator gives you all the information necessary to develop intelligent financial decisions. You will feel like a financial rock star; with profound insights into your loan’s terms and costs, you will be equipped to tackle any challenge with a sound understanding of the paying back terms and costs of your loan.

Essential Functions of Commercial Loan Calculator

Estimate Monthly Payments: One of the main tasks of professional credit estimators is to provide monthly loan payment estimates. By maintaining track of loan amounts, interest rates, and repayment terms, businesses can determine how much of their budget they will need each month, which helps a company determine if debt can be handled in its cash flow.

Calculate Total Interest Costs: Interest rates can impact the repayment cost of the loan. Comparing the different types of loans and choosing the best deal according to the financial condition of the company is quite important; businesses can effectively manage long-term loan repayments and maintain a strong credit score.

Analyse Loan Terms: Various types of loans come with different terms and conditions, including fixed or variable interest rates and repayment schedules. Professional audits evaluate changes in these terms, including the total cost of the loan and the monthly repayments.

Compare Loans: When considering multiple loan options, a company can use a calculator to compare their financial impact. By entering specific loan information into the calculator, businesses can determine which strategy offers the best terms for lower total interest rates or more manageable monthly payments.

Wrap-Up: Your Financial Sidekick

Therefore, there you have it; your business loan calculator is more than a tool. If utilised well, you can harness the power of the financial journey. This absolute gem inspires your confidence to make financial decisions and navigates you through a better understanding of loans and repayment terms.

Start your journey with Nucleus today and discover how our tailored financing solutions empower your business towards sustainable growth.