- Blog

- /

- Check-In to Success: Navigating Hotel Loans for Property Development

Check-In to Success: Navigating Hotel Loans for Property Development

Estimated Read Time: 5 Minutes

Diksha Chaphe , 27 June, 2024

Today, a rapidly expanding industry drives tourism and plays a pivotal role in local economics worldwide. Despite being capital-intensive, nature is a lucrative opportunity essential for developers, real estate investors, and ambitious entrepreneurs.

In 2022, the UK hotel industry had a market size of £16.42 billion, substantially rising from £11.28 billion the year before. The UK hospitality sector, which includes hotels, is projected to increase at a compound annual growth rate (CAGR) of 2.53% from USD 57.39 billion in 2024 to USD 65.02 billion by 2029.

Secure financing for hotel projects poses significant challenges and risks associated with market volatility, seasonal fluctuation in demand, and extended project timelines. Traditional lenders frequently say that leading financing requires a deep understanding of sector dynamics; Nucleus offers tailored funding solutions designed to mitigate risk and foster project success.

Understanding Hotel Loans

Hotel financing involves several development stages, each with unique challenges and opportunities. Understanding these stages is critical to successfully navigating the financing process for your hotel projects.

- Construction loans: Essential for funding ground-up development, covering expenses ranging from acquiring land to completing the building.

- Bridge loans: Temporary funding to meet needs until long-term funding or projection completion.

- Mezzanine financing: A hybrid financing option combining equity and debt, perfect for leveraging extra funds unavailable through traditional loans.

Key factors in Loan Evaluation:

- Location: Easy access, close to business hubs and attractions.

- Market demand: Evaluation of regional aspects and tourism.

- Project Feasibility: The project has been thoroughly examined, including risk assessments and financial projections.

- Developer experience: Proven track record and proficiency in carrying out projects of a similar nature.

Advantages of Nucleus

Nucleus stands out with its specialised knowledge and tailored approach. Secured or Unsecured: Which Business Loan Is Best?

- Knowledge: Vast property finance knowledge includes a thorough understanding of intricate market dynamics.

- Flexible Terms: Understanding the terms and taking advantage of Customized loan agreements that consider project timelines and cash flow needs is essential.

- Simplified Procedure: Quick and easy application and approval procedures that guarantee project funding and start-on-time.

Navigating the Loan Application Process

A successful hotel loan application demands meticulous preparation:

Documentation includes thorough project plans, feasibility studies, and financial statements.

- Market research: Thoroughly examining regional market patterns and the competitive environment.

- Business Plan: A comprehensive document that includes project objectives, schedules, and income estimates.

- Professional Support: Work with knowledgeable advisors to improve credibility and expedite the process.

- Expertise and Networking in the industry: Considering financial advisory in the hospitality field who knows about hotel development.

- Associate for industry: Joining associations such as the British Hotel & Lodging Association can facilitate access to industry insight and networking opportunities.

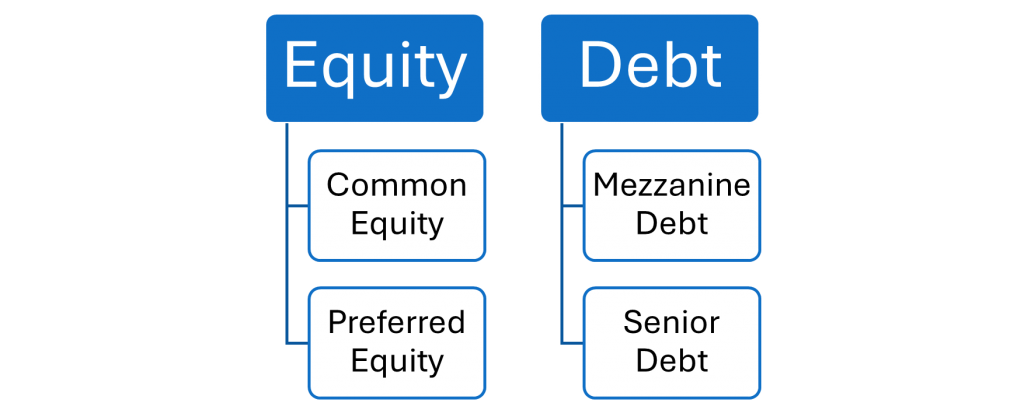

What is Capital Stack?

The different kinds of source funding an organisation or project uses to finance its operations and development are referred to as capital stacks; they symbolise various capital tiers that go into the overall funding structure. Usually, these layers consist of the following:

The Key Components of the Capital Stack

Equity

- Shared Equity: The project ownership stake has the highest return potential but also the highest risk, which is why standard equity holders participate in hotel profits using our revenue management cheat sheet and follow obligations while committing to debt repayments and preferred equity distribution.

- Preferred Equity: This equity funding blends debt with equity features, and investors have preferred rights over the company’s equity holders in terms of distributions and liquidation distribution preferences.

Debt

- Mezzanine debt: Located between equity and senior debt, it is riskier than senior debt usually yields. Still, better returns might be included if it focuses on features like warrants or options to convert equity under specific circumstances.

- Senior Debt: This type of debt has the highest priority of repayments compared to other forms of financing. It usually carries the least amount of risk and offers the lowest interest rates.

Choosing a Lender Like Nucleus:

Consider the following factors when choosing between Revenue-Based Loans (RBL) and Nucleus Business Loans (NBL) for real estate or hotel development projects:

Financial needs: Determine whether you prefer flexible payment based on RBL or a fixed loan amount based on NBL.

Risk tolerance: Evaluate whether you are willing to offer collateral. NBL, being unsecured, might avoid putting the asset at risk.

Cash flow management: Assess how well your company can handle fixed monthly payments NBL versus varying RBL.

Ultimately, both loan kinds have advantages depending on your unique financial circumstances, cash flow predictions, and growing business. Examining terms, repayment schedules, and qualifying requirements is crucial to selecting the option that best fits your hotel development goals.

To sum up, a sophisticated grasp of specialise financing solutions and understanding their benefits and options is essential for the successful development finance of hotel loans; every stage of funding from construction is crucial in this article nucleus assure you with financing opportunities that help your success in the face of fluctuating market and cyclical demand with collaborative knowledge offering expertise and flexibility to understand the challenges and implement effectively.

Ready to unlock your hotel project’s potential with expert financing? Sign up to Nucleus for tailored solutions and industry insights!