- Blog

- /

- Leveraging Short-Term Loans for Immediate Business Needs

Leveraging Short-Term Loans for Immediate Business Needs

Estimated Read Time: 5 Minutes

Pooja Jaiswal , 24 September, 2024

“Financial Freedom is available to those who learn about it and work for it” – Robert Kiyosaki.

Imagine that you stand at some crossroads with your small business: expand, merge, or improve cash flow. How do you get the necessary funds? Short-term loans might be the answer. These kinds of loans come in several types, each having its advantages and disadvantages. It is vital to understand how these loans work, the best way to obtain them, and where to apply.

Short-term loans allow an SME to satisfy a wide range of needs in order to increase its working capital, expand an operation, purchase equipment, replenish inventories, or even take care of unforeseen situations. The application usually is less involved in comparison with long-term loans, but the interest rate can be a little higher.

Types of Short-Term Loan

Business Lines of Credit (LOC)

LOC is one of the most convenient ways of attaining funds. Like credit cards, LOC can be used repetitively. It provides the flexibility of accessing funds anytime unless the credit limit is not surpassed, and interest is only payable on the amount used.

Invoice Finance

With invoice financing, borrowers can utilise outstanding invoices as collateral in exchange for immediate funds. Whereas lenders, in exchange for the risks associated, can charge a certain percentage as a fee. After deducting this fee, the rest of the amount is what borrowers receive, which is also suitable for businesses with irregular cash flow, retailers, and service industries.

Merchant Cash Advances

In this financing option, businesses receive a lump sum amount upfront based on the future debit and credit card sales. It is considered advance against future revenue. It is preferable for businesses who need finance quickly, have high credit card sales volume, and are looking for easier ways to access funds.

Pros and Cons of Short-Term Loans for SMEs

| Pros | Cons |

| Quick and easy application and approval process. Typically, it takes not more than 24 hours. | Higher Interest rates as compared to long-term loans. |

| High approval rate, even for the ones with low credit scores, such as startups. | Bigger repayment instalments in regular intervals. |

| Quick access to funds. | Smaller loan amount. |

| Less stringent application process. | A collateral or personal guarantee is required in exchange for risks on the lender’s part. |

| Varied range of funding options. | Not suitable for longer projects. |

| Successful repayment of loan amount helps build a credit history. | Penalties in case of delayed or early repayment of the loan amount. |

| Fulfils short-term requirements such as boosting working capital, expansion, etc. |

Best Practices for Securing Short-Term Loan

Securing short-term loans is crucial for SMEs to manage cash flow, grab potential growth opportunities, and cover unexpected expenses. Here are a few best practices SMEs must follow:

- Conduct a complete financial analysis for strategic planning. Properly understand your business’s requirements, examine its performance, and, based on that evaluation, search for the best finance option that aligns with your business goals.

- Lenders assess borrower’s credit score to check for creditworthiness. Maintain your credit score and business credit history.

- Don’t just approach traditional banks; consider alternative lenders, credit unions, or online lenders specialising in SME loans. Each may have different criteria and loan terms.

- Maintain current financial records, including balance sheets, income statements, and cash flow reports. This demonstrates your commitment to responsible borrowing and business growth.

- If you have a limited credit history, consider offering collateral or a personal guarantee to strengthen your loan application.

- Review the loan term carefully.

- Seek professional advice whenever and wherever required for financial planning.

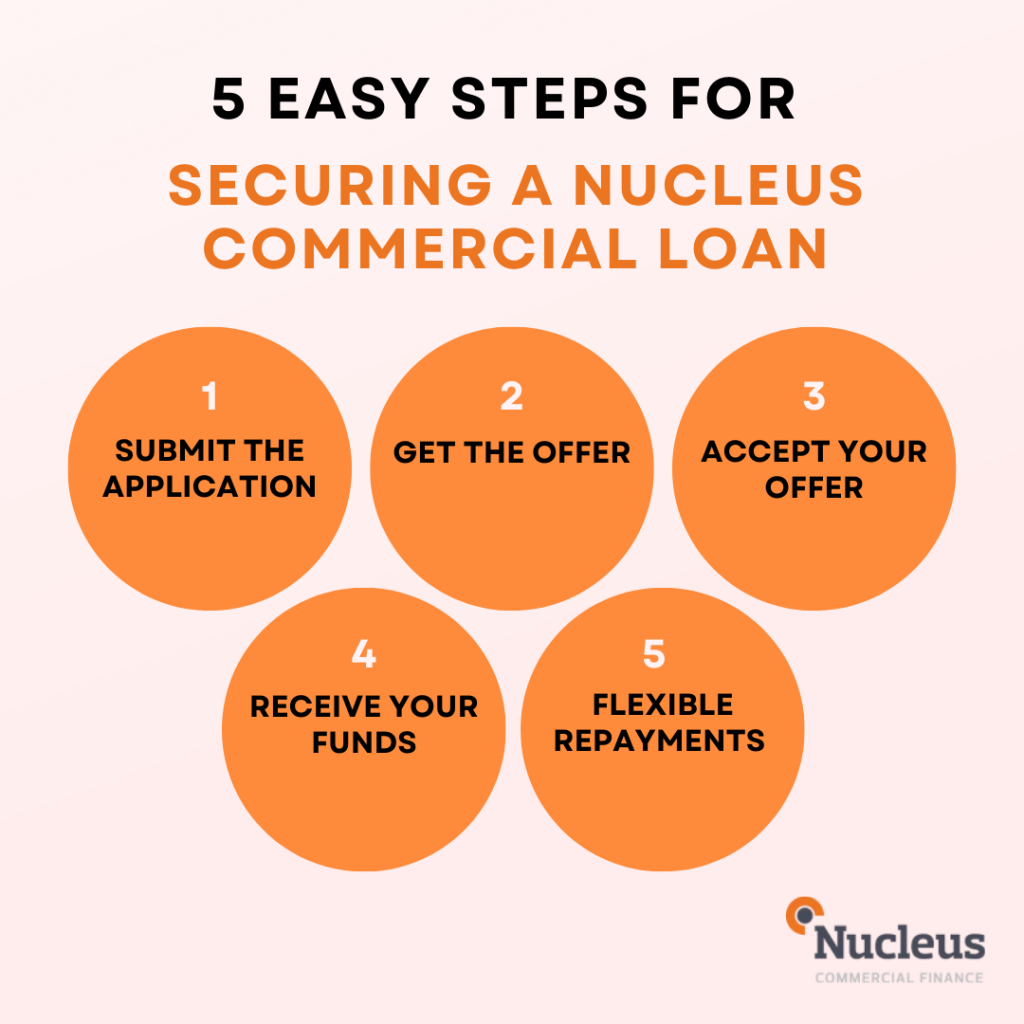

How to Apply for a Nucleus Short-Term Loan

Step 1: Submit the Application

Make sure which loan type best aligns with your business goals. Once you decide on the loan type — Nucleus Business Loan (NBL) or Revenue Based Loans (RBL) — submit your online application, which requires essential details, such as business information, trading information, loan information, and personal details.

Step 2: Get the Offer

Our API system evaluates your application quickly and generates loan offers based on your financial profile and needs.

Step 3: Accept Your Offer

Once you receive the offer, you can decide to proceed with the agreement. If you choose to move forward, you can sign your documents remotely and effortlessly on any device, anytime, ensuring a seamless and effortless process.

Step 4: Receive Your Funds

After enclosing the agreement and completing the paperwork, Nucleus releases the funds directly to your business account.

Step 5: Flexible Repayments

Nucleus offers straightforward repayment options to make managing your loan hassle-free.

Learn more: A Step-by-Step Guide For Commercial Loan Applications

Case Study

Industry: Technology – SaaS Business Tool

Amount: £50,000

Reason: Growth

Scenario:

Business Optix needed a cash flow boost to help with its ambitious two-year growth plan. The business offers a cloud-based platform that enables organisations to run their core operations, grow the scale of their business and make transformational changes.

They were frustrated by the rigidity of the products available and their services. This was due to the business licensing their software annually and thus having irregular cash flow. The banks couldn’t see past this and realise the strength and vision of the business.

Solution:

Business Optix spoke to Nucleus about when they had struggled with more traditional lenders and were exploring other options in the market. Due to the varied types of funding options, the personalised way Nucleus works, and the time taken to understand each business, it was clear that Business Optix was a well-run, structured and funded business.

The business secured approval for £50,000 in funding. The funding enabled them to future-proof the business and ensure continuous growth to kickstart an ambitious plan to expand turnover within a few years.

Note by Client:

“We needed a fresh approach and a lender that understood our business. We put the business out to a number of people, and it quickly became very obvious to us that Nucleus was a really good fit for our business.”

Read more: Client Stories | Nucleus Commercial Finance

Summary

Short-term loans offer quick and flexible funding solutions to UK small businesses, helping them overcome varied challenges involving strategic financial management.

Get started with Nucleus today to discover our types of loans and features that can give SMEs the necessary funds to prosper. Loans have advantages over other loans regarding flexibility and tax savings, but they also have drawbacks like debt load and collateral requirements.

Ultimately, choosing to apply for a small business loan should align with your objectives, financial situation, and capacity for repayment to ensure long-term success and growth in a cutthroat industry.